Launch Your Own On-Chain Credit Vault

AlphaPing operates mandate-driven, non-custodial on-chain credit vaults. Partners define mandate scope and economics.

You define the investment mandate, risk boundaries, target assets, and constraints. AlphaPing translates the mandate into enforceable on-chain mechanics.

AlphaPing designs, deploys, and continuously operates the vault — including protocol integration, collateral selection, risk enforcement, and ongoing execution.

Vaults operate under the AlphaPing framework with isolated risk, non-custodial structure, and verifiable on-chain accounting, while remaining dedicated to your mandate.

What AlphaPing Handles

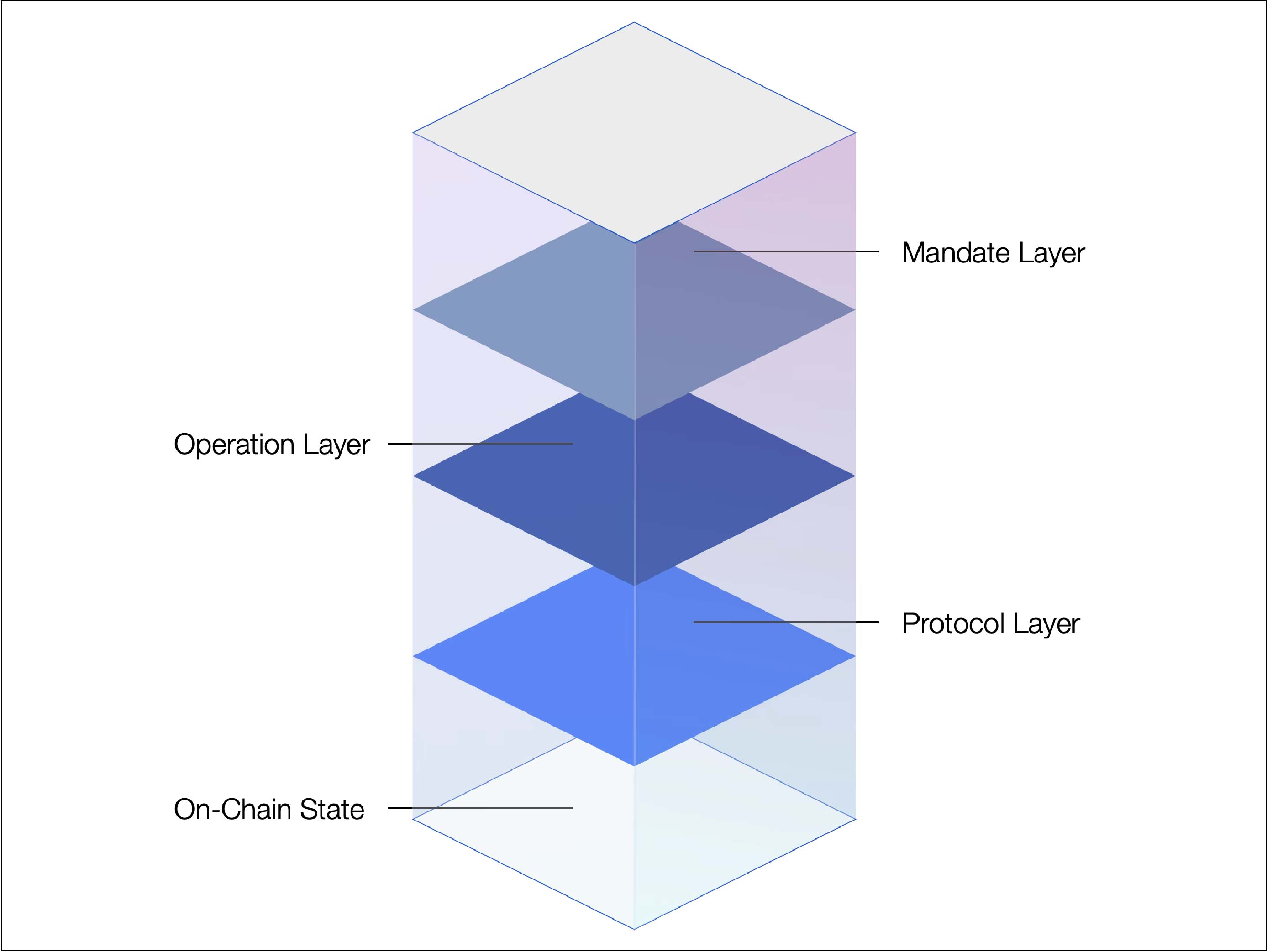

AlphaPing operates an execution and operation layer that enforces defined mandates across third-party protocols.

AlphaPing formalizes mandates into explicit constraints defining permitted actions, risk boundaries, asset scope, and exit conditions. Mandates are rules enforceable across market conditions without discretionary judgment.

AlphaPing operates the operation layer that translates mandates into live on-chain systems, including vault deployment, parameter configuration, maintenance, and enforcement. Operation is rule-based and focused on execution discipline, not strategy selection or subjective decisions.

AlphaPing integrates and maintains third-party protocols per mandate parameters, including configuration and compatibility monitoring.

Activity, positions, transfers, and accounting outcomes are recorded on public blockchains and remain independently observable.

Operating & Economic Boundaries

Operation, control, and economics are defined by mandate and protocol mechanics. AlphaPing operates the operation layer without custody or discretionary decision-making, and outcomes remain directly verifiable on-chain.

AlphaPing operates vaults within predefined mandates

Partners define mandate scope and commercial terms

Vaults remain non-custodial at all times

Capital executes through third-party protocols

Outcomes follow protocol and market behavior

Why Partners Work with AlphaPing

AlphaPing operates credit vaults as infrastructure, translating mandates into enforceable mechanics, integrating third-party protocols, and coordinating with relevant ecosystem participants — including collateral issuers and large counterparties — within predefined constraints.

We maintain operational readiness across market conditions, monitoring protocol-defined processes and facilitating execution strictly according to mandate and protocol rules, without custody or discretionary control.

Observed Behavior Under Stress

Stress behavior is documented from executed on-chain transfers during 1–8 November 2025.

During the documented window, AlphaPing CORE vaults processed sustained withdrawal demand while remaining operational. Evidence is independently reproducible from public Ethereum transfer events.

USDC and WETH CORE vaults processed withdrawals throughout the documented stress window.

Withdrawals were honored according to protocol mechanics, without discretionary intervention.

Discuss Your Mandate and Operating Requirements

Speak with the AlphaPing team to discuss mandate structure, operational scope, and whether our operating model fits your requirements.